Sunday, January 18, 2015

Exter’s Pyramid “In Play” (And Is Martin Armstrong Right?)

Submitted by Paul Mylchreest of admisi.com

Exter’s Pyramid “in play” (and is Martin Armstrong right?)

In a global debt bubble, it concerns us when the benchmark debt security still looks good value, albeit on a relative basis.

Source: Bloomberg, ADMISI

In spite of this, the consensus is (once again) calling for higher US yields and FOMC “lift off.” The two-year Treasury yield has been pricing in the latter…

Source: Bloomberg, ADMISI

…but the question is what is the long end of the Treasury curve pricing in?

Slower growth and lower inflation, most likely. Risk of global contagion, possibly. That the FOMC makes a mistake (in raising rates)…maybe that too.

The Fed might be desperate to raise rates ahead of the next downturn (how embarrassing not to) but this analyst would be surprised to see more than 1 or 2 token 0.25% increases – and that’s if things are rosy.

As we know, the narrative from central banks can change at the slightest hint of trouble, e.g. Ballard’s QE4 comment during last October’s selloff. Watch the spin as the Fed portrays lower energy prices as “transitory” and no reason to alter its desire to tighten, while the ECB’s desire to ease only grows, even though neither is achieving its mandate on prices.

Do what thou wilt shall be the whole of the law?

The key point is that you can’t normalise rates in the “Winter” phase of a long wave (Kondratieff) cycle. There is just too much debt. It’s debt that drives these cycles and eventually brings them to an end.

This is the fourth cycle since the Industrial Revolution and the longest by far. The lack of a gold standard has allowed the central banks to extend it through unprecedented credit creation.

Here is our timing of these cycles:

1788—1843 56 years

1844—1896 53 years

1897—1933 37 years (1937 was a policy error when recovery established in our opinion)

1934—? 81 years (and counting)

The next cycle doesn’t begin until the excess debt from the previous cycle has been purged. Historically this has occurred via debt deflations of varying length and severity. In a world of unlimited credit creation, inflating the debt away remains an option and we question whether renewed onset of debt deflation will ultimately be dealt with via central bank-created inflation? Mr Abe and Mr Kuroda are conducting such an experiment.

In the meantime, we see a possibility that the Fed could raise the Fed Funds rate in several months’ time only for long-term Treasury yields to continue their decline, while the ECB could instigate sovereign bond QE and long term sovereign yields (ex-Germany certainly) could rise…which was the experience of the US (QE1, QE2 and QE 3 pre-taper).

Talking of flattening yield curves…

We’ve been looking at yield curves in the run up to the last two peaks in the S&P 500 in March 2000 and October 2007.

It basically doesn’t matter which part of the Treasury curve you choose in terms of 2s, 5s, 10s and 30s, but spreads declined to roughly zero, or negative, prior to the equity market peaks.

Here is the 2s10s...

Source: Bloomberg, ADMISI

The 2s30s...

Source: Bloomberg, ADMISI

The 5s10s.

Source: Bloomberg, ADMISI

And the 5s30s, although we could have added the 2s5s and 10s30s just for the hell of it.

Source: Bloomberg, ADMISI

Could the same thing happen again in a structurally (much) lower interest rate environment this time around?

Well 190 bp of flattening in the 2s30s might be pushing it, but 46bp in the 5s10s is certainly possible in the fairly near future with the way things are going. Funnily enough, if the 10-year Treasury yield was in line with the 10-year Bund, the 2s10s spread would be -8bp, i.e. close to zero.

While we expect the S&P to be lower at the end of 2015 than the beginning of 2015, our point is that more flattening might be in order prior to a major correction in equity markets like the S&P 500, Footsie, DAX,, etc. In general terms, it also suggests that it might be too early to lose faith in “bond proxies” such as Utilities and some Consumer Staples.

A significant further flattening in the curve is looking increasingly more likely...

Indeed, the major story for us right now is that the broad concept incorporated in “Exter’s Pyramid” is in operation. This something we mentioned in Autumn last year and it’s occurring across currency and credit markets and, to some extent, in equities.

To recap, John Exter (a former Fed official, ironically) thought of the post-Bretton Woods financial system as an inverted pyramid resting on its apex, emphasizing its inherent instability compared with a pyramid resting on its base. Within the pyramid are layers representing different asset classes, from the most risky at the top down to the least risky at the bottom.

He foresaw a situation where capital would progressively flow from the top layers of the pyramid towards the bottom layers.

“…creditors in the debt pyramid will move down the pyramid out of the most illiquid debtors at the top of the pyramid…Creditors will try to get out of those weak debtors & go down the debt pyramid, to the very bottom."

Below is his drawing of the inverted pyramid as he saw it in the late-1980s, when the riskiest assets were Savings & Loans (“thrifts”), Third World debt and (relevant to today) junk bonds, etc.

We think that Exter’s Pyramid went “live” in in late-June/early-July 2014 when the dollar index (DXY) began to strengthen…

Source: Bloomberg, ADMISI

…along with junk spreads.

Source: Bloomberg, ADMISI

The perfect illustration of Exter’s Pyramid is across the credit markets (as seen via ETFs) with capital flowing from HY through IG…

Source: Bloomberg, ADMISI

…and from IG into Treasuries.

Source: Bloomberg, ADMISI

There is some evidence that this is happening intra-equity market.

For example, here is the chart of the S&P 500 High Quality Index versus the Low Quality Index, where “Quality” is measured in terms of growth and stability of earnings and dividends.

Source: Bloomberg, ADMISI

The point about Exter’s Pyramid is that there is a large amount of capital in riskier financial assets in the upper layers of the pyramid which can flow downwards.

Consequently, the valuations of perceived “safe” assets could obviously overshoot if there is no let up.

Capital flows into dollar assets are a major part of this process right now.

We haven’t mentioned Martin Armstrong’s “Economic Confidence Model” (ECM) for quite some time but we’ve been thinking about it recently. The ECM, based on 8.6 year cycles, is often very successful at tracking turning points in the “hot money” flow of global capital.

Now is not the time for a detailed explanation, but for anybody not familiar with the ECM, Armstrong’s report “It’s Just Time” (google it) from several years back is one of the best we’ve ever read and provides excellent background.

The ECM’s peak on 2007.15 (i.e. late-February 2007) picked out the emergence of the sub-prime problems almost to the day. It did the same with the peak in the Nikkei Index in December 1989 and, we know this because we checked, the Great Crash of 1929 (which was 7 x 8.6 years back from the Nikkei’s peak). The 1987 crash was an intermediate peak in the cycle which ended in 1989.

What is fascinating is that the current ECM cycle peaks on 2015.75, i.e. at the end of September this year. The low point of this cycle was 2011.45, i.e. June 2011 which Armstrong refers to as:

“The 2011 bottom was the peak in oil and gold and the start of the breakout in stocks and the beginning of the Euro Crisis in full bloom.”

In contrast, we think that the 2011 low in the ECM marked the low in the dollar…here is the DXY again back to 2010.

Source: Bloomberg, ADMISI

Furthermore, the intermediate peak of 2013.60 (July 2013) and the intermediate low of 2014.68 (early-September 2014) also align quite closely with the dollar, as is obvious from the chart.

Armstrong is talking about this September 2015 being the peak in the “bond bubble”.

If our interpretation is correct, the dollar AND long-term Treasuries could have further strong upward moves between now and late-Summer 2015.

Credit to Zero Hedge

The Grand Chessboard of World War III

After the economic collapse, what comes next? Answer: The grand chess board of World War III!

This article is not for the faint of heart. If one desires to keep on burying their head in the sand, then go watch the NFL Playoffs. Of course, if we do not collectively wake up the majority of sheep which inhabit this country and motivate them to action against the globalists, the acronym “NFL” will soon come to mean Not For Long. And “Not For Long” will soon represent how long the sheeple of this country can keep their heads buried in the sand as the country disintegrates into total chaos. No amount of cognitive dissonance, normalcy bias and general apathy can protect even the most unaware Americans as to what lies in their immediate future.

The ISIS Factor

CNN and Wolf Blitzer’s 115,000 average number of listeners as well as the rest of the mainstream media have been treated to the fiction, since last summer, that ISIS was the beneficiary of high grade military equipment “accidentally” left behind by our military when we pulled out of Iraq. This explanation is laughable and does not even fit the criteria for a bad cover story. Yet, the MSM has fallen right into line and has not dared to question the official narrative.

It is standard operating procedure for the American military to destroy the weapons that are left behind in a theater of war. In recent times, this work has been contracted out to private corporations. I have spoken with a man who was contracted to do this work in Iraq. The task of his team was to destroy the weapons in three different locations out of a possible set of sites that numbered about three dozen. My contact’s group was in the process of destroying weapons when the CIA showed up and ordered them to stand down. The rest, as they say, is history as these became the weapons that ended up in the hands of ISIS. The mechanized vehicles were used as transport vehicles that the private contractors were instructed by the CIA to load with weapons, ammunition and supplies. What he told me next should send chills up and down the collective spines of every air traveler. Hundreds of crates of RPG’s were loaded on the supply trucks and shipped to ISIS. This is how sophisticated America military hardware ended up in the hands of ISIS instead of being destroyed.

Private American contractors were involved in the transport of these weapons to “exchange points”. The contractors were told that the weapons were being handed off to elements of the Iraqi military. I was told that not one contractor believed the CIA created cover story. The weapons were always designed to fall into the hands of ISIS.

More Boots On the Ground In the Middle East

I have periodic contact with a person, which I have learned, has both a nephew and a son in the Middle East and both are in the Army. What I have learned is that there is a massive buildup of troops in both Kuwait and Jordan. The Army is forming massive assault units (i.e. offensive vs. defensive) in Kuwait. In Jordan, both F-35’s and F-16’s are arriving in a base in Jordan. I was able to confirm the buildup of troops and planes in the Middle East from one of my military contacts. What I have also learned is that the prevailing belief is that fighting ISIS will provide the excuse to put boots on the ground into Syria as a means to effect regime change. This is the “Plan B” to what Obama was unable to accomplish in the Fall of 2013 when the United States was unable to successfully “frame” the Syrian President, Bashar Hafez al-Assad, for the use of chemical weapons against government dissidents in Syria.

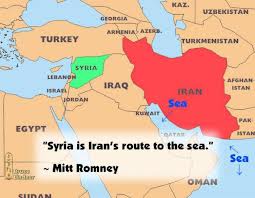

Assad’s days are numbered. Whether it is ISIS that takes down Assad, or it is the American military, it will not matter, there will be regime change in Syria. Obama’s handlers will then be free to install a puppet government. Syrian oil will be seized as was the case in Iraq. When Syria is subjugated, according to Obama’s plan, Iran can be leveraged more effectively. Iran is the ultimate goal. Why? Because the solvency of the Federal Reserve is being threatened and to understand the roots of the coming world war and the roll out of tyrannical martial law, over this issue, I need to take a brief look at the historical underpinnings.

The Birth of the Petrodollar

A novel system for monetary and exchange rates was established in 1944. The Bretton Woods Agreement was developed at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire, from July 1-22, 1944. This conference established the US dollar as the reserve currency of the world.

A novel system for monetary and exchange rates was established in 1944. The Bretton Woods Agreement was developed at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire, from July 1-22, 1944. This conference established the US dollar as the reserve currency of the world.

The Banksters (e.g. Rockefellers’) reveled in their new found fortune. As a result of the Bretton Woods Conference, all nations desiring to purchase Middle East oil had to first purchase dollars and use these dollars to complete the purchase of oil.

Nearly everyone inside of our country benefited from this system. Americans basically enjoyed a stable currency minus the inflation rates of about 5% per year which served as an informal tax that went into the Federal Reserve banksters’ pockets. Thus, the Petrodollar was born. If the Petrodollar were to ever be successfully undermined, our currency would sink faster than a submarine with screen doors because there is nothing backing up our money.

The old guard at the Federal Reserve worked from 1913 to 1971 to rid the economy of the Gold Standard so that they could enforce debt slavery upon the American people and government through encouraging a prolonged out of control spending spree accompanied by the awarding of lucrative unbid contracts to the elite’s corporations which would dramatically drive up the deficit and line the pockets of the Federal Reserve owners.

The coming war with Syria is merely the opening act. The main act, following Syrian subjugation, will consist of the United States and Israel and Britain attacking Iran. Iran is the prize needed for the old guard of the Federal Reserve to maintain its strangle hold on the global economy. On the surface, attacking Iran seems like a good idea if it will preserve our economy. However, the risks associated with this course of action are astronomical. The leadership at the Federal Reserve believes that Iran must undergo a regime change in order for the dollar to survive and avoid the ravages of hyperinflation.

Why Every American Should Fixate On This Issue

The Petrodollar is in real trouble and so is your bank account, your job, your ability to get gas, medicine, food and water. America is literally a push button away from economic destruction. In the eyes of the Federal Reserve and Goldman Sachs, the Petrodollar must be maintained at all costs, even at the cost of fighting a world war.

On the Precipice of WWIII

Syria is the first real domino in the coming conflict that threatens all life on this planet. The take down of Egypt and Libya was mere foreplay. The real action will commence when the ISIS conflict spills over into Syria and topples Assad.

Syria is the first real domino in the coming conflict that threatens all life on this planet. The take down of Egypt and Libya was mere foreplay. The real action will commence when the ISIS conflict spills over into Syria and topples Assad.

Make no mistake about it, America is headed towards war with Syria and don’t think for a second that this war will imitate, in any way, the wars in Iraq and in Afghanistan. The previous wars compared to Syria, and later with Iran, is child’s play compared to anything we have been involved with in the history of this nation. The “saving the Petrodollar” strategy being pursued by the Federal Reserve is a high stakes gamble with you, your children and the future of humanity being used as their collateral.

Because all roads to Tehran run through Damascus, Iran is the actual target of the Federal Reserve’s war intentions, because Iran is doing the unthinkable as it is waging war on the old guard of the New World Order, by selling its oil to Russia, China and India for gold and this is a dire threat to the solvency of the dollar. ISN’T IT INTERESTING THAT ISIS SURFACED, ARMED WITH AMERICAN WEAPONRY, ONLY A SHORT-TIME AFTER A DIRECT INVASION OF SYRIA WAS REJECTED BY POPULAR WORLD AND AMERICAN OPINION? HOW MANY OF THESE “COINCIDENCES” DOES IT TAKE TO FORM A LEGITIMATE CONSPIRACY? AND NOW THE WAY INTO SYRIA IS THROUGH TERRORISTS SUPPLIED AND TRAINED BY THE CIA!

First Syria, Then Iran

Before one can invade Iran, with the threat of Russian intervention looming, Syria must first be occupied and fortified by US/NATO forces. Occupying Syria allows America and her allies to invade Iran from several directions. Through Syria, we will see air-strikes which will fly unimpeded over Northern Iraq. Also, and most importantly, the occupation of Syria will be a threat to the mobilization of forces inside of Russia who would then come under the American long and short range missile batteries, which will be installed in Syria. These missiles will surely be armed with battlefield nuclear warheads. This deterrent could provide the Americans with enough time to occupy most of Iran before Russia or China could act with its conventional forces. This strategy, however, dares the Chinese and Russians to not invoke the use of large scale nuclear weapons in the biggest game of chicken ever played on this planet.

The Unexpected Twists and Turns of the Coming World War

I do not expect China to attack the U.S. in the Middle East, at least not at first. Most experts, instead, expect the Chinese to move on Taiwan.

I never thought that elements of the Red Dawn scenario would ever come to fruition, but how many times have we seen the media tell us what is going to transpire in advance of an event? However, if China is determined to make good on its threats to attack the U.S., then the Red Dawn scenario is in play. And while we are at it, I would anticipate that China would approach the Southwestern underbelly of the United States via Central America, given that the Chinese control the Panama Canal and are rumored to have troops throughout Central America, including Mexico. And if things really go crazy, all sides may launch its ICBM missiles and their submarine based nuclear missiles at each other’s homeland and then all bets are off. Perhaps, you now know why I constantly refer these criminal banksters who have hijacked our government as psychopathic.

Iran Is Public Enemy Number One

Because of Iran’s threat to the Petrodollar, Iran occupies a similar, but much more dangerous position than did Iraq in 2001. As we now all know, 9/11 provided the motivation to invade Iraq. No, Iraq was not responsible for the 9/11 attacks and President Bush did admit as much. But that did not prevent Bush from capitalizing on the emotion from 9/11 so that America would confuse the issues and tacitly accept the invasion of Iraq in which the Iraqi’s were lumped together with all Middle Eastern nations who “want to kill us because of our freedoms.”

Specifically, why did Iraq have to be invaded? Simple, Saddam Hussein was attempting to sell his oil in currency other than Federal Reserve Notes (i.e. the Euro). He was threatening the Federal Reserve and at that time, he was also a threat to the central bankers in their headquarters, otherwise known as the Bank of International Settlements, which controls all central banking. During that time frame, these banksters would have done anything to prevent a threat to the world’s reserve currency, namely the dollar, which they controlled.

Following the completion of the second Iraq war, Exxon and BP controlled 80% of Iraqi oil fields and nobody would be selling Iraqi oil in either the Euro or for gold. However, the game has changed, Iran has replaced Iraq as the major threat to the stability of the Federal Reserve Notes.

Iran is economically destroying the U.S. Unfortunately for every man, woman and child in America, that day of economic reckoning is quickly approaching. China has commenced buying Iranian oil in gold. India has followed suit, as have the Russians. The days of the Petrodollar are numbered and therefore, so is the only source of backing of our dollar. Have you and your family prepared for the collapse of the dollar and ultimately the collapse of society? It is coming and it coming fast.

The Russians and the Chinese Have Warned the U.S.

Creating the pretext for fighting a war, and then successfully selling the American public on the need to fight the war, is one thing. However, winning the war, is quite another. How serious are the Chinese and Russians at standing up to the imperialistic United States? Considering that both Chinese President Hu and Major General Zhang Zhaozhong have threatened the United States with nuclear war if they invade Iran, the prudent opinion says that this is the newest version of the “Axis of Evil’s” line in the sand, and it has been clearly drawn. While all eyes are on Ukraine, the real prize and the key to the solvency of the BRICS is Iran and its willingness to accept gold for oil payments.

The Dawn of the American Empire

America is in a very difficult dilemma. If we acquiesce to the Russian and Chinese threat of war for invading Iran, our dollar will collapse. The Federal Reserve will not back down. They have already killed Gaddafi and Hussein in order to preserve the Petrodollar. They are not going to back down to the Iranians, Chinese and Russians because it will not be their children doing the fighting and dying, it will be our children. Now, does it make sense on why the elite are driving down the price of Gold so they can buy up as much as they can for as cheaply as they can? They intend to be the last men standing at the end of the next great war to end all wars.

And just how will the elite sell us on war? You can bet there will be more false flag events, with each one being more horrific than the previous one. And guess who will get the blame? It does not take a rocket scientist to accurately speculate that the last of the false flag events will be nuclear and then all hell will break loose.

Conclusion

It is clear, it is hands off Iran or it means WWIII. And with Putin shutting off gas to Europe, the world took a big step towards to the next world war. Does anyone really think that the Federal Reserve is going to take this lying down? Could the path to WWIII be the reason that so many bankers have left the United States because they know what is coming?

Credit to Common Sense

Subscribe to:

Posts (Atom)